4 Ways to Make Money In A Bear Market

Bear markets are periods of losses for an investor, but with the right investment strategy, you can make a profit in a bear market. With a few tips, you can find out ways to make money in a bear market. Generally, investors tend to pull out their investments when there is a bear market.

This strategy is justified as no one wants to intentionally lose money, however, there are still ways to take advantage of the situation and make money. In this article, we will be discussing a few ways to make money in a bear market. But first, let’s consider what a bear market is.

What Is A Bear Market?

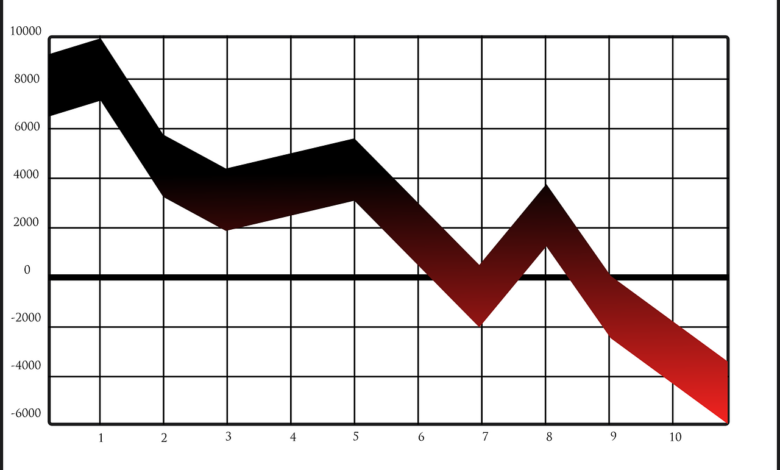

A bear market refers to a period in the stock market when prices fall by 20% on average or more. They are often caused by falls in the general market or index like the S&P 500.

Bear markets usually occur during economic recession or depression.

Although bear markets are associated with downsizing in stock market season, you can still make money if you know the right strategies.

Ways To Make Money In A Bear Market

1. Short Selling

Short selling is an investment strategy used by experienced investors during a bear market. It occurs when an investor borrows shares to sell back believing that the stock price will fall in the future. If all goes as planned, and the price drops, he can buy the borrowed shares at a lower price to cover the short position and make a huge profit.

For example, if you borrow stock ABC at $50 per share and the stock price declines to $40, you can buy the stock back at $40 to close out the short position, thereby making a profit of $10 per share. However, short selling is very risky since the price of any asset can rise massively.

2. Buying High Yield Dividend Stocks

Buying high-yield dividend stocks is one of the ways to make money in a bear market. This is because dividend stocks are backed up by the company’s net income while stock prices are determined by stock market traders. If the stock price falls, the company will still be generating income and paying dividends.

3. Short ETFs

Short Exchange Traded Fund (ETF) involves the collection of stocks that generates returns when the underlying price decreases. ETFs are similar to short selling but the difference is that ETFs’ profits are inverse of the market index. This inverse relationship of ETFs makes it good for investors who want to hedge against such a market downturn.

4. Buying Call Option

Using a call option is one of the ways to make money in a bear market. It gives an assurance that a specific stock will increase in value within a short period. However, remember that a call option is secondary and can expire if you’re not careful.

Conclusion

Knowing ways to make money in a bear market will keep you from losing money, especially if you are a long-term investor. I hope some of the ways listed in this article will help you avoid losing in bear markets.

Good luck!