Top 5 Saving Apps With The Best Interest.

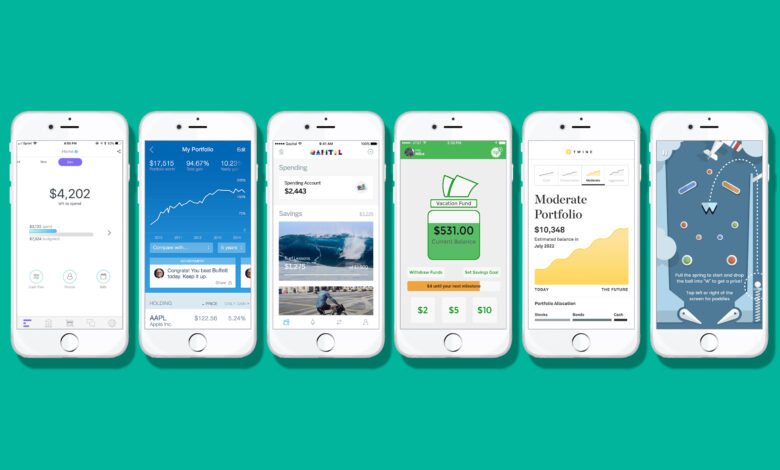

Saving is almost impossible as the cost of living increases everyday but it is a necessity for every human with goals to save. Nevertheless, there are apps that have made the habit of savings easier.

Due to the advancement in technology, it’s not advisable to use a crafted wooden bank – “kolo” as Nigerians will term it

There are legitimate savings apps that will help you to save up your money without stress. This article covers 5 important savings apps that are widely known for their best interest rate.

ALAT

ALAT is a programmed app that is premeditated to manage/save up your money. ALAT gives up to 13% interest when you save or invest.

It also has some other advantages like a regular bank account. Your ALAT debit card (Visa, Mastercard, Verve card) is also delivered to you at home or in your location of choice at zero cost. ALAT debit card is internationally acceptable and can carry out any transactions within and outside wherever you are.

You can easily download from Play Store or the Apple store.

CowryWise

CowryWise is another long-term secured digital wallet that helps to invest or save up for the rainy day with amazing returns.

With just one account on CowryWise, you can save in multiple different ways. To save on CowryWise, you can start with as low as #1000 which would qualify you for for an interest paid on your savings account at midnight.

Check-out the app on Play Store or Apple store.

PiggyVest

PiggyVest is a flexible online savings platform that gives best interest with simple investment which are made readily accessible to everyone. Challenge yourself to meet your goals by saving towards a common goal or target.

On PiggyVest, you could customize the rules and duration of your target savings as you wish. PiggyVest gives 10-15% interest on savings and over 25% interest on investment.

PiggyVest is available on Google play store and Apple Store.

SumoTrust

SumoTrust is a savings and investment platform that helps Africans to save and invest seamlessly without stress. The primary goal is to help you raise and manage money to suite you while they train and expose you on how to start a successful business with best interest rates.

SumoTrust pays high interest of 10-15% to all out users with good interest.

You can download from Play Store or Apple store.

Kuda bank

Kuda bank is another of Nigeria’s first mobile-online bank licensed by the Central Bank of Nigeria (CBN). It takes responsibility to save as you spend without any charges. Kuda includes tools for tracking your spending habits, saving more and making the right money moves.

Kuda Customers get 25 free transfer to other banks every month and to other banks cost ₦10 each.

Summary.

Savings is a physical investment which could be for private interest or any other purpose reserved for. The apps listed in this article will enable you to achieve all your savings goals with the best interest.