How to Build Your Credit Score with Credit Card

At this point you might be wondering what it means to build credit score with a credit card; yeah the statement does sound kind of confusing. However, building a credit score with a credit card is possible and doable. Knowing how it works will help you improve your finances. This article will help you to understand how to use a credit card to build your credit score quickly.

In this article, I will be showing you how to use a credit card to build a credit score in 2022, and why it’s good to build credit. However, before this article will make sense to you, you have to understand some basic principles like finance, profit and loss, and so on.

Before we go into how to use a credit card to build a credit score in 2022, let’s talk about what a credit card is, shall we?

What is a Credit Card?

A Credit Card is an issued payment card that enables users to pay for goods and services in order to augment debt. Depending on the card issued to you, most credit cards have a start-up or annual fees attached to them.

How to Build Credit Score with a Credit Card In 2022

1. Authorized User

You don’t necessarily need to have your own card to build a good credit store. You can become an authorized user on someone else’s card by becoming a primary card owner; having full access to theirs. You can apply for your own card after becoming an authorized user. When getting your own card, ensure you know your bank’s application rules and limits.

2. Own a secured Credit Card

A secured credit card enables you to make cash deposits to a bank and establish a line of credit that you can use for your purchases to the card’s limit.

3. Payment Due Date

Before you start using the card, check out the payment due date, so you know how to better use the card. Making payments on time will help boost your chances of having a good credit score.

4. Use the Card To Make Purchases

You earn points when you make purchases and this will go a long way in helping you have a good credit score. The higher your purchases the more points you’ll earn. You can also see similar ways to earn redeemable points from purchases in this article.

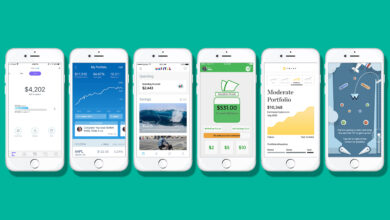

5. Auto Pay

Sometimes, you can forget to make your monthly payments or renewals and this can affect your credit score negatively. So, in order to maintain a good payment record, you can set the account to auto-pay which will automatically make payment for you on the date you choose.

6. Track Your Spending Better Terms:

Spending lasciviously can decrease your chances of having a good credit score and also is a huge disadvantage to your finances. Be careful.

Now that we’ve seen how to build credit score with a credit card in 2022, let us quickly check out why it’s good to build credit.

Benefits of Building Credit

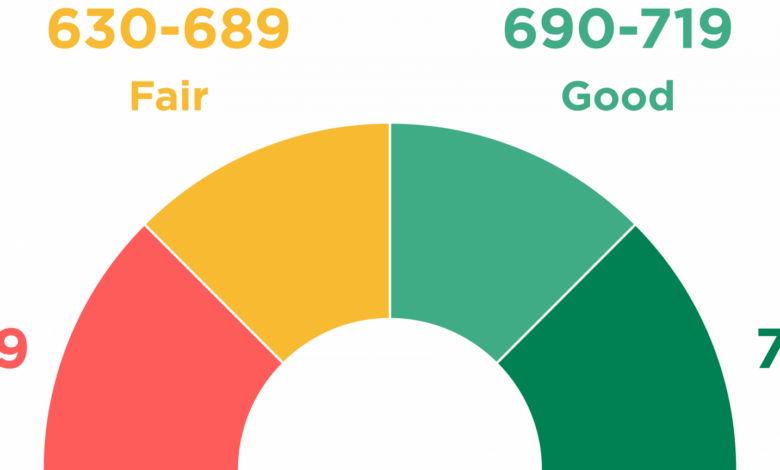

- Better Approval Rates: With a good credit score, you are more likely to be approved for credit products like loans.

- Low-Interest Rates: The higher your credit score, the lower your interest rate, which can save you hundreds of dollars on your personal loans, mortgages, etc.

- Improved Terms of Service (ToS): A good credit score grants you better terms on basically any kind of loan product.

Conclusion

From the article, you can see that how to build credit score with a credit card in 2022 isn’t that difficult and shouldn’t take much of your time. You can work most of these actions into your routine, and start reaping these amazing benefits.